Australia

The most significant development in Australia over the past month has been the RBA’s shift in its policy bias from tightening to a neutral stance. Underpinning the change was a downgrade to the RBA’s growth forecasts, with GDP growth revised down to 3.0% in 2019 and 2.75% in 2020, while inflation is projected to be 2.0% for 2019 (down from 2.25%) before moving to 2.25% in 2020. These forecasts would not generally imply a need for the RBA to cut rates, but the bank acknowledges risks to the downside, reflecting weakness in China, the downturn in global growth, and the impact of the downturn in housing. After having been relatively optimistic on housing over recent years, the RBA is now more focused on the risks faced by the household sector, particularly the potential for a negative wealth effect on consumption and a downgrade in residential investment growth. Markets, however, have gone one step further and are now fully pricing in a cut in the cash rate by November 2019.

Employment growth remains robust, with 39,100 jobs added in January. January saw solid growth in full-time employment numbers, which added 65,400, offset by a fall in part-time employment of 26,300. The unemployment rate remained steady at 5.0% in seasonally adjusted terms while the participation rate inched higher to 65.7%. The AIG Manufacturing Index recovered further in February. The input price index was steady but still indicating strong growth, reflecting elevated costs for energy intensive sectors, while the average wage index moderated and is sitting around its long-term average.

Australia’s balance on goods and services expanded in January from a surplus of $3,769 million to $4,549 million in seasonally adjusted terms. Exports of metal ores and minerals added $279 million and coal, coke and briquettes added $351 million. Non-monetary gold exports netted $1,308 million, offset by net general merchandise imports of $883 million. Australia’s current account deficit narrowed in the December quarter to $7.2 billion, but the ABS indicated that soft net exports detracted 0.2 points from the December quarter’s GDP growth, which came in at 0.2%.

Global

Backtracking from central banks and a move away from a tightening bias has given markets a reprieve, along with positive developments in trade negotiations between the US and China. However, the recent rally in shares has been in contrast to softer economic data and downgrades in growth and inflation forecasts, pointing to a loss of momentum in global economies. An apparent 180-degree shift in the Fed’s thinking since the end of 2018 has markets believing that the Fed is done hiking rates for this cycle and that the next move is likely to be down. GDP growth appears to have moderated. The extremely weak retail sales data for December dragged down overall growth estimates. Initial claims for unemployment insurance also lifted to their highest level since early 2018. This is often a good leading indicator for unemployment. The ISM Manufacturing PMI indicates slowing growth in the manufacturing economy over December and the early part of 2019.

Eurozone GDP grew 1.1% year-on-year in the December quarter according to revised data, down from 1.6% in the September quarter, and has fallen from its recent peak of 2.8% over the year to September 2017. Contractions were observed in Greece and Italy (both -0.1%) while German growth was static through the year. The ECB has warned that the slowdown—thought to be temporary—appears to be persisting due to global trade tensions, uncertainty surrounding Brexit, and recent financial market volatility. The German government cut its growth forecast for 2019 to just 1.0%, and there are calls for the government to adopt policies to counteract the slowdown. The Bank of England has predicted a further slowdown, with a 25% chance of the economy falling into recession by mid-year.

The rate of Chinese growth, already at a 28-year low, continued to slow in the early part of 2019. China’s Premier Li Keqiang announced a cut to the country’s economic growth target for 2019 to 6.0–6.5%, down on 2018’s target of 6.6% and the slowest pace since 1990.

Commodities

Crude oil stocks in the US declined for the first time in the past six weeks. As a result, the crude spot price continued to rise in February to US $65.03 per barrel Metals also maintained their rally in February, with gains in Copper, Nickel, Tin, Zinc and Lead. Gold fell to US $1,315.29/oz.

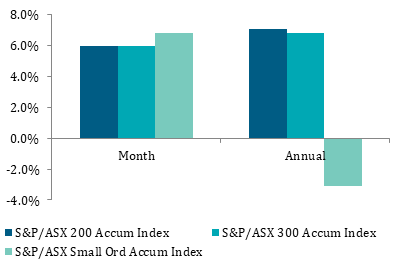

Australian Shares

Australian shares have been marching higher since the end of 2018, with the S&P/ASX 200 Index returning 10.1% over January and February, and in price terms now fully recovered since the start of the sell-off in October 2018.

Energy and Information Technology sectors once again performed strongly over the month. But it was the Financials sector that was the real driver of returns, with the recovery in banks and insurance providers also offering a boost to asset managers. February’s earnings season was mixed but generally beat expectations.

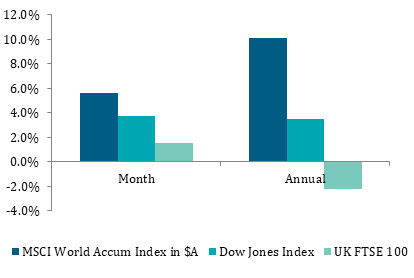

International Shares

The global market rally continued apace in February and has extended into March, with the risk-on environment supported by a shift in central bank bias away from further tightening. While volatility remains elevated, it has eased significantly since December’s spike.

While there are still some areas of contention, progress appears to be made on a trade deal between the US and China, which has supported equities markets. However, German auto manufacturers are now the ones in the firing line, with President Trump threatening tariffs of up to 25% on German car imports.

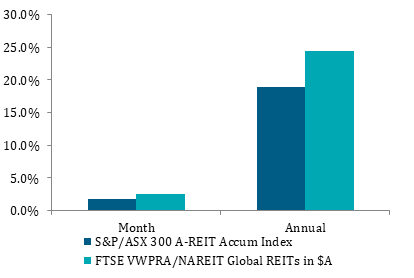

Property

The S&P/ASX 200 A-REIT Index returned 1.75% in February, building on January’s gains but underperforming most other ASX sectors. Themes such as a weaker housing sector, ongoing low wages growth, and the rise of Amazon continue to affect retail-exposed AREITs. Globally, REITs returned 15.3% in Australian dollar hedged terms over 2018, but in US dollar terms they were down 5.6%. The sector delivered modest gains as global growth and reflation expectations unwound through 2018 and investors sought defensive assets with resilient income streams.

Fixed Interest

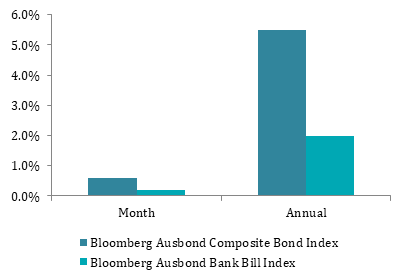

Even as equities have rallied, money has still flowed steadily into bond markets, with yields further compressed through February and early March. This is in contrast to the market dynamic at the end of 2018, in which growth shocks and fears over Fed tightening led to a flight to safety, with investors favouring defensive shares and bonds.

The RBA’s more neutral stance saw markets price in a 25bp cut in the cash rate by November 2019. The Australian 10-year Treasury yield jumped to 2.19% ahead of the RBA’s March meeting before resuming its downward path.

Australian Dollar

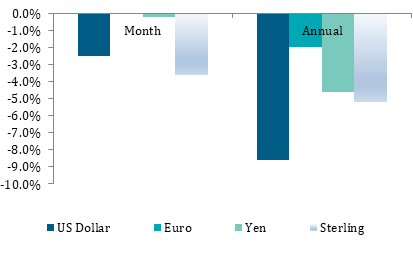

The outlook for the Australian dollar is complicated by the conflicting moves in interest rate differentials and commodity prices. With the Fed pausing its interest rate cycle, one might have expected the US dollar to weaken further, however this has been offset by the shift in RBA policy bias. In the meantime, Australia’s bulk commodity prices and the terms of trade have strengthened. Over the three months to the end of February 2019 the Australian dollar has fallen 4.1%, losing value against the US dollar, British pound, euro and Japanese yen.

Key Investment Indices

| As at 28 February 2019 | 1 month | 3 months | 6 months | 1 yr | 5 yrs | |

| Australian Shares | % | % | % | % | % | |

| S&P/ASX 200 Accumulation Index | 6.0 | 10.0 | -0.3 | 7.1 | 7.3 | |

| S&P/ASX 300 Accumulation Index | 6.0 | 9.9 | -0.4 | 6.8 | 7.3 | |

| S&P/ASX Small Ordinaries Accumulation Index | 6.8 | 8.0 | -3.1 | 3.5 | 7.7 | |

| S&P/ASX 300 Industrials Index | 5.8 | 7.0 | -3.3 | 3.9 | 7.6 | |

| S&P/ASX 300 Resources Index | 6.9 | 22.2 | 12.3 | 19.2 | 5.6 | |

| International Shares | Value | % | % | % | % | % |

| MSCI World Accumulation Index in $A | 5.6 | 5.2 | -1.8 | 10.1 | 11.7 | |

| MSCI World Accumulation Index ($A hedged) | 3.4 | 1.5 | -3.5 | 2.4 | 9.4 | |

| MSCI Emerging Markets Index in $A | 2.7 | 8.9 | 2.0 | -1.3 | 9.0 | |

| Dow Jones Index in $US | 25,916 | 3.7 | 1.5 | -0.2 | 3.5 | 9.9 |

| S&P 500 Index in $US | 2,792 | 3.0 | 0.9 | -4.0 | 2.6 | 9.7 |

| FTSE 100 Index in £ | 7,075 | 1.5 | 1.4 | -4.8 | -2.2 | 8.4 |

| Nikkei 225 Index in ¥ | 21,385 | 2.9 | -4.3 | -6.5 | -3.1 | 7.6 |

| Deutsche Boerse Index in € | 11,516 | 3.1 | 2.3 | -6.9 | -7.4 | 3.5 |

| Hang Seng Index in HKD | 28,633 | 2.5 | 8.0 | 2.7 | -7.2 | 4.6 |

| Shanghai Shenzhen CSI 300 Index in RMB | 3,669 |

14.6 |

15.7 |

10.0 | -8.8 | 11.0 |

| Property | % | % | % | % | % | |

| S&P/ASX 200 A-REIT Accumulation Index | 1.8 | 9.9 | 4.1 | 18.9 | 13.0 | |

| S&P/ASX 300 A-REIT Accumulation Index | 1.8 | 9.7 | 4.4 | 18.9 | 13.2 | |

| FTSE EPRA/NAREIT Global REITs in $A | 2.5 | 7.0 | 3.7 | 24.4 | 10.9 | |

| Fixed Interest | % | % | % | % | % | |

| Bloomberg Ausbond Bank Bill Index | 0.2 | 0.5 | 1.0 | 2.0 | 2.1 | |

| Bloomberg Ausbond Composite Bond Index | 0.9 | 3.1 | 3.4 | 6.2 | 4.7 | |

| Barclays Global Aggregate Index ($A Hedged) | 0.1 | 2.5 | 2.3 | 3.7 | 4.5 | |

| Inflation | % | % | % | % | % | |

| Australia CPI | 0.2 | 0.5 | 1.0 | 1.8 | 1.7 | |

| Currencies (relative to $A) | Value | % | % | % | % | % |

| $US | 0.7095 | -2.5 | -2.9 | -1.3 | -8.6 | -4.5 |

| Japanese ¥ | 79.0630 | -0.2 | -4.8 | -1.0 | -4.6 | -2.8 |

| Euro € | 0.6238 | -1.8 | -3.4 | 0.7 | -2.0 | -0.7 |

| Sterling £ | 0.5351 | -3.6 | -6.7 | -3.6 | -5.2 | -0.1 |

| Chinese Yuan | -2.8 | -6.6 | -3.8 | -3.7 | -2.9 | |

| Commodities | Value | % | % | % | % | % |

| S&P Goldman Sachs Commodity Index ($US) | 4.5 | 4.9 | -9.0 | -3.8 | -8.1 | |

| Oil ($US/barrel) | 66.03 | 6.4 | 12.4 | -18.0 | -7.2 | -11.0 |

| Gold ($US/ounce) | 1,313.24 | -0.6 | 7.6 | 9.3 | -0.4 | -0.2 |

| Iron Ore ($US/tonne) | 82.23 |

Sources: Lonsec, Atchison Consulting, Colonial First State